UBS Chief Investment Office have just released the UBS Alpine Property Focus 2019 providing information designed to give potential buyers of ski property an independent overview of the luxury ski market. The report focuses on top vacation apartment markets with a price per square meter of over CHF 8,500.

What prices can we expect from the luxury ski market?

The luxury ski market across the globe is an exciting dream for many buyers even if you are not a ski lover there is still clear signs of appreciation. The opportunity to own a property in your favourite ski resort to be enjoyed with friends and family for many years. If you are considering buying or selling a ski property, this report can provide you with invaluable information. Which resorts have the highest price per sq.m and which resorts have had the biggest appreciation in the last 12 months?

Firstly, what makes a luxury home, according to UBS Chief Investment Office data, it is above 480 sq.m and a 2,500-sq.m land plot However, it is not always the size that matters.

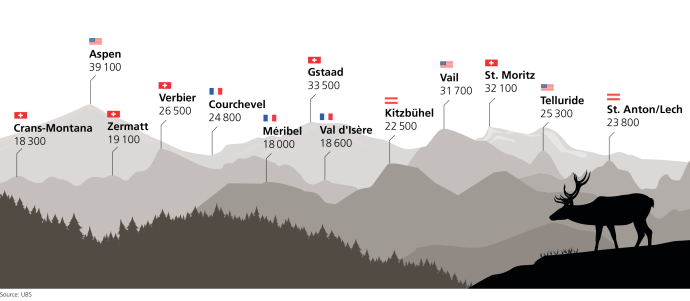

From the graph below, we can see the Aspen is well clear in the luxury market for a price per sqm (CHF). What is interesting in this table is that the highest price per sqm prices are from resorts that are known to everyone from your beginner to your most advanced skier. This may seem a very obvious statement to make but for potential investors, which resorts are up and coming and do these resorts have potential to grow year on year? The likes of Chamonix or Morzine in France or Davos in Switzerland surely have that potential? Is there an investment opportunity for a new resort to break into this top tier bracket and give a huge opportunity to buyers looking for an investment in appreciation?

Whose responsibility is it to push the price per sqm barriers? The developers, agents or the resorts themselves and where they place the resort brand and what investment is made in the infrastructure of the resort. Could there be an opportunity for a lesser know resort to break into the top tier of prices? What makes a ski resort achieve these huge prices per sqm? DO you research on these questions when looking at which resorts to invest. SnowOnly Investment guides on each resort can help you.

(above chart provided by UBS Chief Investment Office)

Which ski resorts are showing should you consider investing your money?

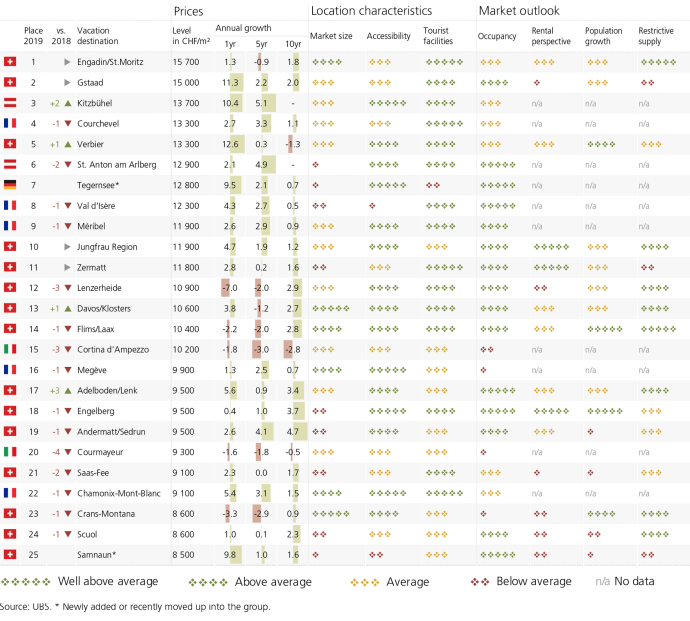

According to the chart below from UBS Chief Investment Office (based on resorts apartments with a price per sqm greater than 8,500 CHF) the annual growth column gives us information into resorts that have sustainable growth and if location characteristic and market outlook will support this growth beyond 2019/2020 season.

3 of the top 5 resorts to show the biggest annual growth in the last year are from Swiss based resorts, with Verbier at 12.6%, Gstaad at 11.3% and the newcomer, Samnaun with 9.8% growth. All have excellent access to airports and relatively short transfers.

Accessibility seems to be such a key factor in ski property due to more buyers coming from overseas looking for a place that is not to far from the airport after a long haul flight. It is no surprise to see the likes of Chamonix in France, Tegernsee in Germany & Verbier in Switzerland all with transfers of less than 2 hours.

Unlike local domestic markets, there are a huge proportion of international buyers (and sellers) in the ski sector. This diverse market means that risks are much more widely spread in many cases, with global wealth transfers from investors in places like Hong Kong, Russia and the Middle East helping to buoy demand. Of course, perhaps the most significant growth in demand will come from mainland China, whose government wants to see 300 million winter sports enthusiasts by 2022 building momentum around the marketing for the 2022 Beijing winter Olympics, where the world will be watching.

(above chart provided by UBS Chief Investment Office)

What is worth mentioning is that not all buyers are looking for an investment and some are purely looking for a lifestyle purchase and some money to cover the overheads from rental income. If you are reading this article it is probably because of your love of skiing and being in the mountains and having a property in any of these destinations is something that can benefit you and your family to benefit from exercise, fresh air and a balanced life.

Given the exclusive nature of high-end properties and consequent low supply, the rental market can be quite lucrative if you play your cards right. Knight Frank research shows that the average rental return for a four-bedroom chalet in Gstaad, for example, is €17,000. In the same resort, you could expect an occupancy rate of as much as 100% in high season and 60% in low season.

To download the full UBS Alpine Property focus report 2019 click the link and scroll to the bottom of the page. If you are genuinely interested in buying or selling a ski property then this is just perfect for you.

With a strong outlook, 2020 could be the perfect time to invest in the luxury ski property market. Start your planning today, and you could be in time to start viewing properties by the New Year. To get started, download your free buying guides today – and don’t miss the Property Buyer’s Guide to Currency, explaining everything you need to know about protecting your funds when buying overseas.

Apr 15, 2024

Apr 15, 2024